BTC laundering through OTC and onto exchanges - Chainalysis study

Check out past issues of the newsletter along with more interesting crypto content as well as short (but great) conversations with leading crypto industry participants at our newly-launched website www.satoshiand.co

It is no secret that the perhaps the biggest criticism leveled at bitcoin is its role as medium of exchange for illicit activities. In 2018 we had a series of posts on regulation, and these have aged pretty well, unlike a number of the tech specific posts.

The strong use case that drove the first wave of crypto adoption pre-2014 was dark web payments. While it only offers partial anonymity, or pseudonymity, BTC was the de facto medium of exchange for dark web transactions before the advent of privacy coins such as @XMR, @ZEC and Grin that offered complete anonymity became the preferable medium for transactions.

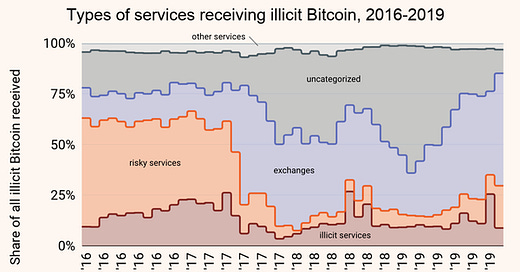

Criminals often need fiat off-ramps to convert their BTC holdings into fiat currencies through OTC brokers and unregulated exchanges. With the inherent transparency of BTC blockchain, trade and transfer activity of these accounts used for illegal activities can be traced. Starting from 2017, exchanges became the dominant outlet for converting BTC acquired through illegal activities.

Source: Chainalysis

While exchanges have always been a popular off-ramp for illicit cryptocurrency, they’ve taken in a steadily growing share since the beginning of 2019. Over the course of the entire year, blockchain software vendor Chainalysis traced $2.8 billion in Bitcoin that moved from criminal entities to exchanges. Just over 50% went to the top two: Binance and Huobi.

Source: Chainalysis

Apparently a majority of these accounts used to launder money are held by corrupt OTC brokers who facilitate the conversion of crypto into fiat. The problem, however, is that while most OTC brokers run legitimate businesses, some of them specialize in providing money laundering services to criminals. OTC brokers typically have much lower KYC requirements than the exchanges they operate on. Many of them take advantage of this laxity and help criminals launder and cash out funds, usually first by exchanging Bitcoin and other cryptocurrencies into Tether as a stable intermediary currency before they presumably cash out into fiat.

70 of the OTC brokers in the Rogue 100, a list of 100 suspicious OTC brokers published by Chainalysis, are in the group of Huobi accounts receiving Bitcoin from illicit sources. 32 of them are in the group of 810 accounts receiving the most illicit Bitcoin, and 20 of them received $1 million or more worth of illicit Bitcoin in 2019. In total, these 70 OTC brokers received $194 million in Bitcoin from criminal entities over the course of 2019. Interestingly, none of those 70 Rogue 100 accounts operate on Binance, though it’s possible some of them also have accounts there or on other exchanges as well.

Meanwhile in Crypto Wonderland...

“Nervos Network Sets Up A $30 Million Grant Fund”

Nervos Network has set up a $30 million public grant fund to sponsor external developers building on its blockchain infrastructure. Announced Thursday, the fund will pay developers in the combination of cash and CKByte tokens, and all submitted projects will be made public to source feedback from the broader community, Nervos co-founder Kevin Wang told CoinDesk. Individuals, teams and companies can begin submitting applications for improving the firm’s layer one blockchain Common Knowledge Base (CKB).

“Bill Seeking Exemption of Personal Crypto Transactions In Congress”

A bill seeking to exempt personal cryptocurrency transactions from taxation for capital gains has been reintroduced in the Congress of the United States. Called “The Virtual Currency Tax Fairness Act of 2020,” the bill would establish an exemption for virtual currency expenditures that qualify as personal transactions. Users would then not have to report instances when they spent crypto whose valued had changed relative to the U.S. dollar on day-to-day expenses. Existing tax law struggles to cope with cryptocurrencies, as they sometimes behave as investments, sometimes commodities, and sometimes just like other currencies. It is to this last type of transaction that the bill looks to simplify for crypto traders and users.

“Bux Acquires Blockport”

Bux, the Amsterdam-based fintech that wants to make investing more accessible, has acquired the European “social” cryptocurrency investment platform Blockport. Terms of the deal remain undisclosed, although Bux says the move paves the way for the company to launch its own branded cryptocurrency investment app. Dubbed “BUX Crypto,” it will be available in the nine countries in which Bux operates, and is planned to go live in Q1 this year. In addition, we are told the founders and core team members of Blockport will join Bux and “take ownership” of the Bux cryptocurrency offering.

“NBA Team Launches Blockchain-based App”

Many people think that cryptocurrencies only serve as an alternative payment option. While there are coins that fit this bill, there are other cryptocurrencies that can perform a host of other functions. The NBA can be considered an early adopter of crypto. In 2014, the Sacramento Kings became the first NBA franchise to accept bitcoin as payment for store products and season tickets. Four years later, the same team began mining Ethereum. Recently, Nets guard Spencer Dinwiddie tokenized his contract to get a lump sum payment and reward token holders. Now, the Kings are once again ahead of the curve in combating fake NBA merchandise.

Crypto Twitter Pick

The credential is the last element to be unbundled from college:

- education (MOOCs)

- networks (accelerators)

- credentials (stay tuned)

My bet: P2P credentials

If I trust you & you say X is the best young person you've worked with, that means more to me than a Harvard degree

11:32 PM - 15 Jan 2020

What We Are Reading / Listening To

Progressive Decentralization: A Playbook for Building Crypto Applications by a16z

How Blockchain is Transforming Cross-Border Payments with Michael Dunworth

Overnight Performance of Top 10 Currencies

You are getting this newsletter because you or someone in your organization signed up for this. You can find more stuff to read at our news and research portal, our crypto index token and our upcoming relayer.

Brought to you by Satoshi&Co

This newsletter does not constitute an offering of securities in any jurisdiction. The contents of this note should not be construed as investment advice or as a recommendation to purchase securities. This note is intended for the consumption of the recipient alone and not for public distribution. Please consult a certified financial advisor or other appropriate practitioner as may be appropriate as per your jurisdiction.

ZPX Copyright © 2019